Investment income in a self-directed IRA is supposed to be 100% tax deferred or tax free depending on the type of retirement account you invest with, right? Surprisingly, that is not entirely true. Congress and the IRS have determined that if your investments meet certain criteria, it can subject the returns from those investments to what is referred to as Unrelated Business Income Tax, or UBIT. UBIT is due when your IRA engages in certain real estate activities or receives ordinary income as opposed to passive income from its investments.

What is Passive Income?

Passive income is what you typically receive from standard investments in your IRA account and, most importantly, it is exempt from UBIT. The easiest way to verify if your investment is exempt is to determine if it falls under a passive income category. The following are examples of exempt forms of passive income:

- Interest Income: interest payments on personal notes or trust deeds

- Rental Income*: if it is derived from real property

- Dividend Income: dividends or profits received from a REIT or C corporation

- Royalty Income: income from intangible property rights such as intellectual property; also includes certain oil, gas and mineral leasing activities

- Capital Gains: from the sale, exchange, or other disposition of property, with some exceptions**

*Rental income from leasing equipment or other personal property can be subject to UBIT. However, if the leasing is structured as a financing agreement it could be considered interest income.

**The exemption for capital gains does not apply if it is determined that the intent was to immediately sell the property. There are quite a few factors and scenarios that go into this determination that we will discuss in greater detail in the next installment of Hidden Taxes in an IRA.

What is Ordinary Income?

Ordinary income is defined as income earned from the selling of goods and/or services (i.e. restaurants, tech companies). If you invest in a company that is a C-corporation, that company is paying 21% in corporate taxes on profits before distributing that income or dividends to its investors. UBIT is not due in this scenario because taxes are already being paid on the corporate level. Most corporations in the U.S. are not C-corporations and are either sole proprietorships, partnerships, or S-corporations. Their profits are pushed, or “flow-through,” directly to the owners and are therefore taxed on the individual level. So, when you invest with your IRA account in a “flow-through” LLC company that does not pay corporate tax your IRA income will be subject to UBIT.

What are the tax implications of UBIT?

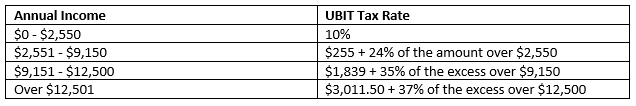

If your IRA earnings are subject to UBIT and are greater than $1,000, you must file with the IRS a 990-T tax return for the IRA. Your IRA will be responsible for paying the tax, you cannot pay for it out-of-pocket.

UBIT Tax Rate 2019

Is there a way to circumvent UBIT?

Yes, there is a way to avoid paying UBIT, but it does not avoid paying taxes on your profits entirely. With your IRA, you can establish a 100% owned C-corporation that your IRA exclusively invests in. With that IRA owned C-corporation, you can invest in an ordinary income producing, flow-through LLC company and the profits will flow directly to the IRA owned C-corporation. That IRA owned C-corporation would then pay the 21% corporate tax and then distribute its income to the IRA account as a dividend exempt from UBIT.

How can I ensure that I understand the tax consequences of my IRA investments?

You should discuss any current or potential investments within your self-directed IRA with a tax professional. Tax professionals should be up to date on any regulations that would incur any sort of tax consequence, even one as obscure as UBIT.

Stay tuned for the next installment of Hidden Taxes in an IRA where we will talk about what real estate investment activities are subject to UBIT.