At some point in your lifetime, you will be required to distribute the assets in your retirement account if you have a Traditional IRA. Required Minimum Distributions (RMDs) generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that they reach age 73.

So what happens if you’ve invested 100% of your retirement dollars in digital currency? You have two options:

Option 1:

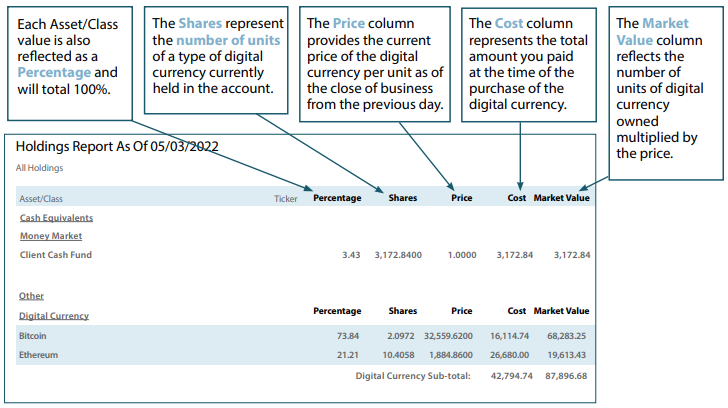

You can take an in-kind distribution of the digital currency, but this will cost you. You will incur processing fees assessed by the IRA custodian. If you’ve drained the cash in your IRA account you will not have the funds necessary to pay the costs associated with selling the investment, which costs are required by the IRS to come from the IRA. If you are under the age of 73 then you could contribute to the IRA to proceed with an in-kind distribution. If you are over the age of 73, the second option is your only option.

Option 2:

Option two involves selling a portion of your digital currency. This is probably the worst-case scenario since you may not be able to recoup the amount you paid for the digital currency – especially if you purchased them within a few years of needing to process an RMD. The saying continues to ring true today, do not put all your eggs in one basket. Having some liquidity in your IRA account when you have non-income generating investments can make a significant difference between your ability to build your retirement, taking a loss, or potentially disqualifying your IRA account.