Real estate is one of the most popular investments to leverage within a Self-Directed IRA. It is a familiar asset if you own your own home or other type of property, it offers diversification from traditional investments, and the rental income and/or capital gains funnel in tax deferred or tax-free depending on the type of account. While the general concept of investing in a rental property through a SDIRA may be similar to investing outside of a qualified account, there are a handful of rules enforced by the IRS that makes the management of this investment quite a bit different. This is because your retirement account is meant to benefit you when you retire, not before. Below are a few of the questions we frequently receive about investing in rental properties with a Self-Directed IRA.

What type of properties can I own with my Self-Directed IRA? Are there any restrictions on the type of property I can purchase?

You are not limited to residential real estate. Your IRA can hold various investment property types, including commercial buildings, retail properties, raw land and acreage (improved or unimproved), single family or multi-unit homes, condos or townhomes, mobile homes, apartment buildings and much more. Your IRA may also purchase foreclosure property as long as the property has already been foreclosed upon.

Can I personally use the property that was purchased with my IRA funds?

No, that would be considered a “self-dealing” transaction which are prohibited by the IRS. Any investment you make with a SDIRA, including a rental property, is to be used strictly for investment purposes only. This means that you and other disqualified persons may not receive direct or indirect benefits from an asset that is owned by your IRA, even if the IRA only owns a portion of the investment.

Can I rent the property to family?

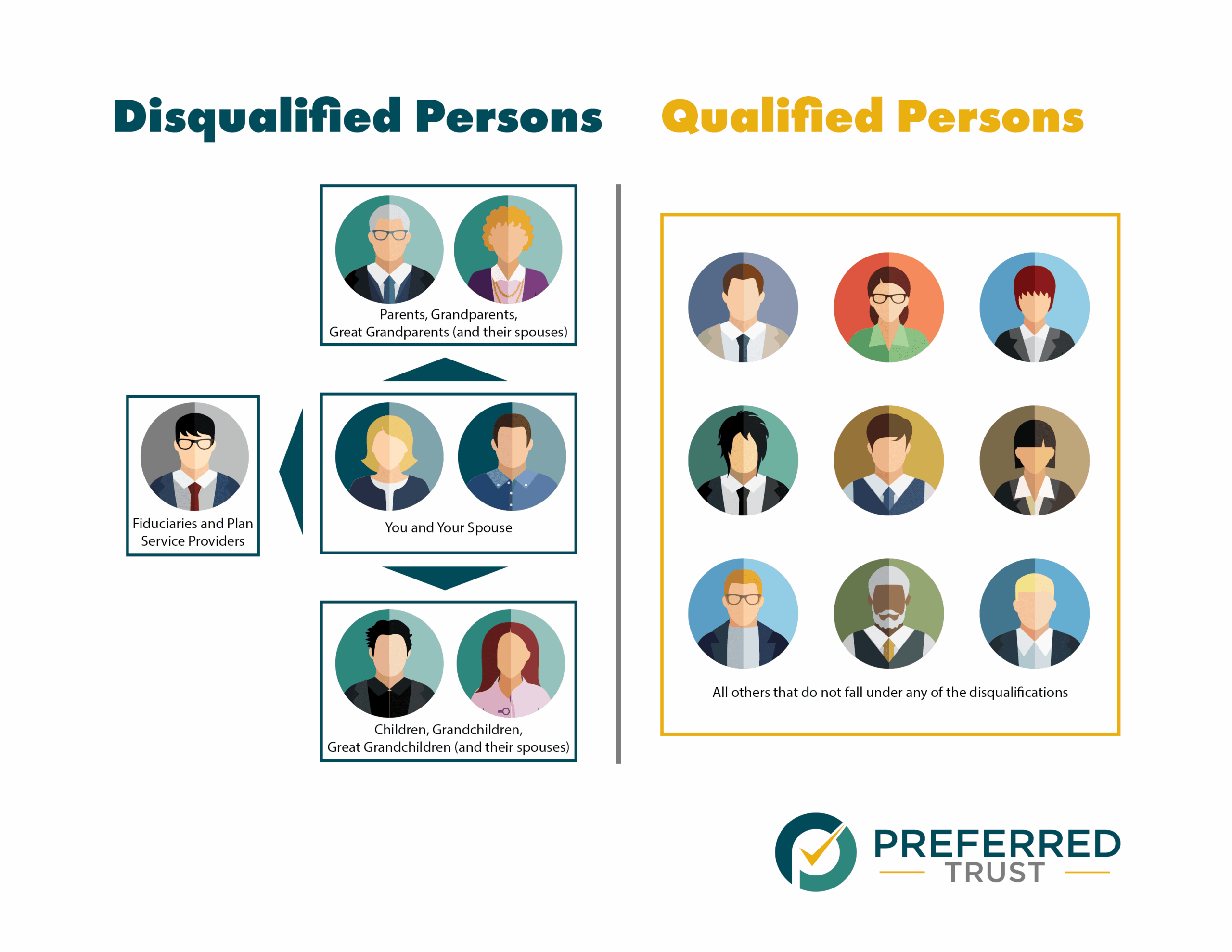

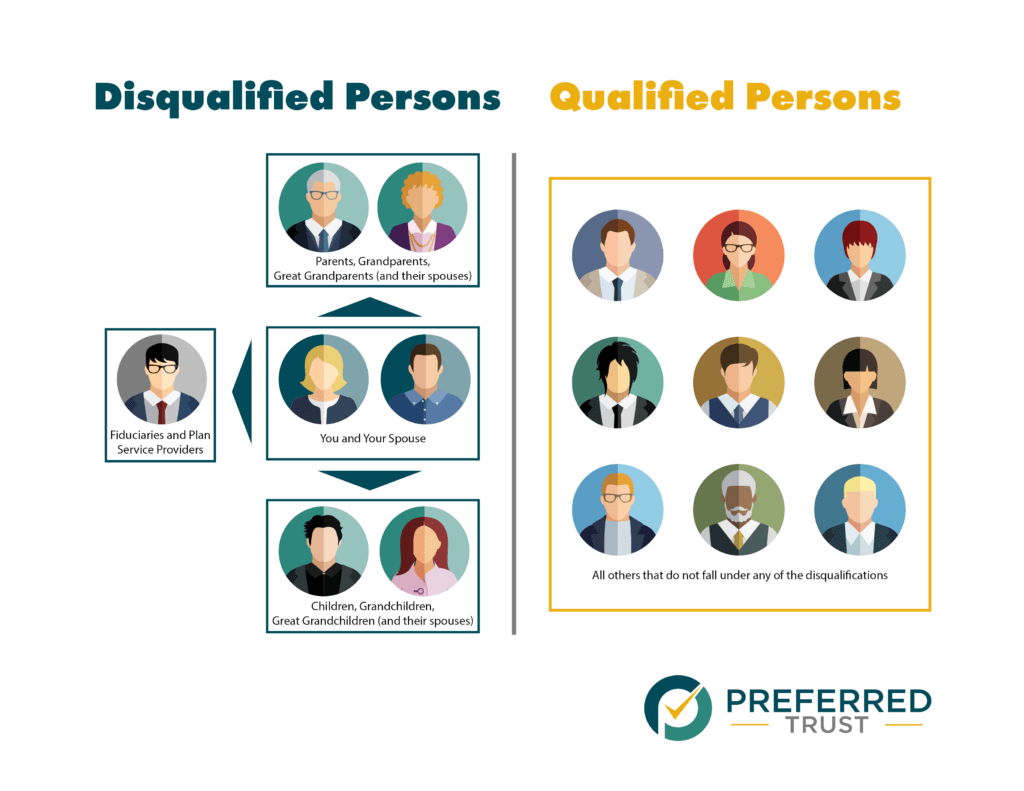

That depends on the family, and we are not saying that to spark a family feud. Disqualified persons encompass lineal “ascendants” and “descendants”, such as parents, grandparents, children & their spouses, nieces and nephews. Other disqualified persons include the institution that holds custody of your SDIRA, as well as fiduciary advisors. Your sister, brother, cousins, friends, and others that are not lineal in relation are fair game.

Keep in Mind: You cannot sell or purchase a property from yourself or your disqualified persons. This would be construed as direct or indirect benefits. Can I act as property manager for my investment property?

Can I act as property manager for my investment property?

Acting as property manager would be considered a “self-dealing” transaction and is prohibited by the IRS. All services and costs for the upkeep of your property must be outsourced to third parties not associated with you or disqualified persons and must be paid through your SDIRA accordingly. Services include any kind of property maintenance and management, i.e. cleaning/landscaping/pool cleaning services, repairs, property management, realtors, etc.

Do expenses such as utilities, repairs, renovations, taxes, and mortgage payments need to be paid from the IRA account?

Yes, any expenses for a SDIRA-owned property must be paid by the SDIRA. The IRS prohibits the use of personal funds to pay for expenses incurred by an SDIRA-owned property. However, if the property is only partially owned by the SDIRA, then the SDIRA pays based on the percentage of ownership. For example, if the SDIRA owns 45% of the property, then the SDIRA will pay 45% of utilities, repairs, renovations, etc.

If eligible, you can make your annual contribution to the SDIRA and use those funds to help pay for expenses. You cannot contribute more than what you qualify to contribute annually to offset costs.

Can the rental income from the property in my IRA flow back to me personally?

In order to maintain the tax deferred or tax-free status of the rental income, all transactions MUST be processed through and held in your SDIRA account. If you wish for the rental payment amounts to be withdrawn/distributed to you personally, the payment must be deposited into the IRA first and then the custodian will process the distribution request and send the funds to you.

DISCLAIMER:

As a custodian, we cannot give advice about specific investments or strategies, but we can provide educational resources and point out the legal issues to consider for your real estate transaction(s). Knowing the rules associated with owning real estate in your IRA is essential and conferring with a legal and tax advisor is recommended. When in doubt, check the proposed transaction with a tax professional and SDIRA custodian before moving forward. In a Self-Directed IRA, you are solely responsible for preventing prohibited transactions. The penalties can be steep, even to the point of disqualifying the IRA.