Selection of the precious metals storage facility is an important part of the investment process. It is up to the account owner to perform all necessary due diligence related to the depository.

Per the IRS, precious metals invested using your IRA must be held in the physical possession of a bank or an IRS-approved nonbank trustee. You may not personally store the precious metals that are owned by your IRA. This rule also applies to indirect ownership through an IRA owned LLC. Specific factors to consider when selecting a depository include location, security, licensing, insurance, storage fees and types of storage offered; segregated vs. non-segregated. It is important to understand that the custodian of your IRA does not physically store your precious metals. They are a separate entity.

Some depositories only provide segregated storage options for certain types of coins and bullion while others don’t offer segregation. It is important to understand the different depository storage options prior to purchasing the metals.

With segregated storage the bullion is inspected, packaged, labeled, and stored, physically separate and apart from the bullion of other Preferred Trust Company clients. Typically the cost of segregated storage is more than the cost of non-segregated store. The segregation of metals guarantees that you will receive the same exact bars or coins that were originally purchased upon distribution.

With non-segregated storage, fungible bullion products (which by nature are commercially interchangeable) are inspected and stored in high-security vaults. Clients that select non-segregated storage benefit from significant cost savings because the bullion is stored in bulk.

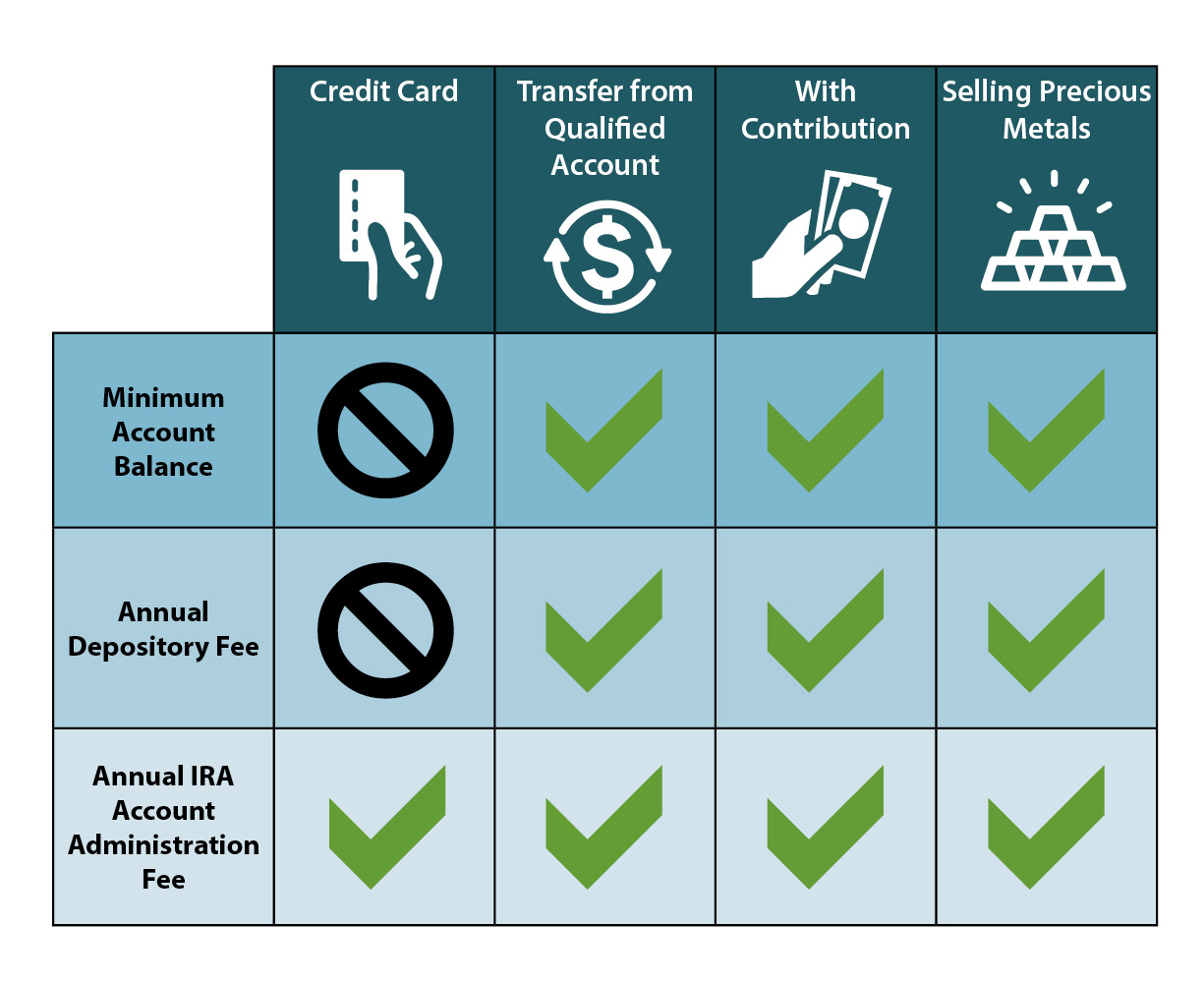

The storage of your precious metals investment at a depository will also incur a separate fee. Custodians and depositories work independently of each other and have separate fees for their services. Most storage facilities provide an invoice to the custodian annually while others bill quarterly. Since the cost of storage is a direct an expense associated with the investment the fee must be paid from qualified funds; this means that you cannot use a credit card or pay the depository directly.

Please visit our Investment Services page to learn more about specific depositories.