Regardless of whether you invest in the conventional market or participate in more sophisticated investments like cryptocurrency, we are all sitting in a world of unknowns right now. However, all politics aside, there are two things that are certain. First, is that the trillions of dollars in government aid will need to be paid back. Second, is that this expectation foreshadows what recourse will most likely be taken, taxes. So, in anticipation of this impending tax event, does your investment strategy also include an optimal tax shelter plan?

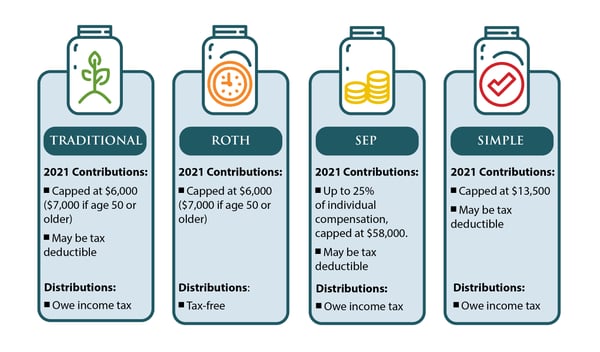

The government has granted you the boon of many forms of tax sheltering vehicles, including the Self-Directed IRA (SDIRA). It is no secret, and yet Self-Directed IRAs are still one of the most underutilized vehicles for tax relief on alternative investments by new and even seasoned investors! SDIRAs are available for individuals in the form of Traditional or Roth IRAs and Solo 401ks, and for the entrepreneurs/business owners with SEP and SIMPLE IRAs.

Since its inception in 2007, Preferred Trust Company has empowered thousands of Americans to invest in alternative assets within a SDIRA. Preferred Trust Company was one of the first custodians to offer segregated custody of cryptocurrency investments for their clients. Per the IRS, digital currency is treated as property for tax purposes, which is why investments in digital currency outside of a qualified plan it is subject to capital gains tax rates. Capital gains tax is determined by multiple factors such as investment duration and your income tax bracket on the state and federal level. However, investors utilizing a SDIRA can invest in digital currency and compound capital gains tax-deferred or tax-free, depending on the type of account. Let us put that into perspective by breaking down the numbers for investing with cash versus investing with qualified funds.

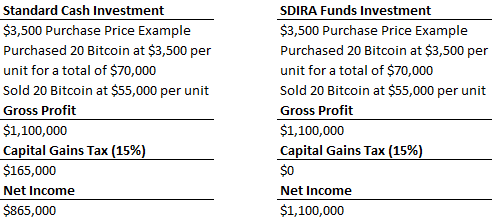

For this example, let us say you purchased 20 Bitcoin with cash and 20 Bitcoin in an IRA at $3,500 per unit toward the end of 2018. You held onto the digital currency for about two years and then sold it near a peak in mid-February of 2021 at $55,000 per unit. Per the IRS, this would be considered a long-term hold, so the long-term capital gains tax rate would apply. Now it is time to compare your net income with the cash investment vs the IRA investment, reflected in the chart below:

*State income tax was omitted from this example as it varies per state.

As you can see, that is a significant amount of capital gains that is sheltered from taxes and can help supplement the growth of your retirement nest egg. So, can you say you are doing everything you can to protect your hard-earned money? If you cannot answer this question with confidence, you could be overdue on a visit with your tax advisor to discuss your options.

Have any questions? Give us a call 888-990-7892 or CLICK HERE to schedule a no obligation consultation to get started on securing your financial future today!

I like this example and agree that capital gains tax is an additional tax that can be avoided by making an investment from within an IRA account. While some may argue that Traditional, SEP, and SIMPLE IRAs will still be subject to taxation in the future when distributions are taken during retirement, it is important to keep in mind that the “Standard Cash Investment” was in all likelihood made with funds that had already been subject to income tax. Assuming that tax rates in retirement will be the same, then the amount of income tax paid in either case would be the same and only a matter of WHEN the income tax was paid. But if income tax rates are likely to increase in the future (as the author perhaps indirectly suggests in the opening paragraph), then this would be an argument in favor of converting a portion of one’s Traditional IRA account into a Roth IRA to make this investment. In an environment of increasing tax rates, this would result in an even higher net gain for the investment by paying less in tax today to convert the Traditional to a Roth rather than wait and pay even higher taxes on distributions from the Traditional later on in retirement.